what should you put for the comany name if yourre self employed to set up direct deposit

When you start a new job, there'due south a lot of paperwork to fill out, from directly eolith documents and benefits enrollments to your W-4 form. Simply when you're a contractor or self-employed person, income taxes work a piffling differently. You volition still have to report your earnings to the IRS, and the companies that utilize your services volition have to report those earnings, too. That's where the W-9 form comes in.

Planning out your taxes is just one aspect of your fiscal plan. Talk to a financial counselor in your expanse today.

W-9 Course Defined

The championship of Form Westward-9 is officially Asking for Taxpayer Identification Number and Certification. Employers employ this class to get the Taxpayer Identification Number (TIN) from contractors, freelancers and vendors. The grade also provides other personally identifying information similar your name and accost.

The form acts every bit an agreement that y'all, as a contractor or freelancer, are responsible for withholding taxes from your income. When you're a full-time employee, your employer withholds some of your income to encompass federal income taxes and FICA taxes (which include Medicare and Social Security taxes). Employers exercise not brand that withholding for contractors.

At the stop of the taxation year, the concern you lot did piece of work for volition use the information on your W-nine to complete a 1099-MISC. This form outlines all the payments made to you. A financial establishment may likewise crave you to written report interest, dividends and upper-case letter gains earned by their customers.

Almost of the time, a company or financial institution will send y'all a bare Due west-nine form to complete before you begin business concern with them. If you need to issue the class, you tin download a Westward-9 from the IRS website.

Westward-9 Form: Who Has to Fill up Information technology Out?

W-9 forms are for self-employed workers like freelancers, independent contractors and consultants. Yous demand to employ it if yous take earned over $600 in that twelvemonth without being hired as an employee. If your employer sends you a W-9 instead of a Westward-4, the company has likely classified you lot every bit an independent contractor. You should confirm with the company that this is the case. Knowing your status tin help you plan your tax return.

The W-9 form allows businesses to keep track of their external workforce. This means you don't transport your Westward-ix form to the IRS. Instead, you lot send it to your supervisor or the company'south man resources department. If you did multiple jobs for multiple companies, you could fill up out a number of W-nine forms in the same year. You will also take to submit new West-9 forms whatever time you change your name, business name, address or tax ID number.

W-9 Form Instructions

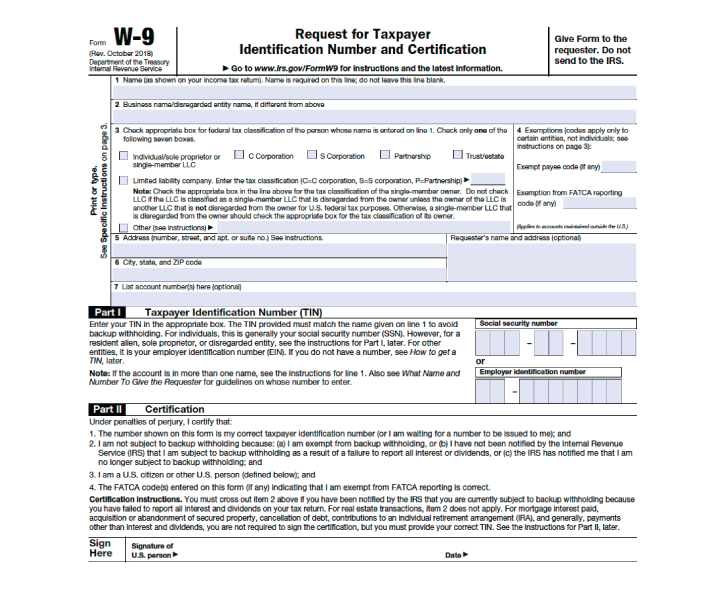

Filling out a W-ix is pretty straightforward. The course itself isn't even an entire page long, excluding the instructions. The business that hires you should fill in its name and employer identification number (EIN). You'll then fill out the form line by line.

Line 1 – Name

This should be your full proper noun. It should match the name on your individual tax return.

Line ii – Business organization proper noun

If you have a business organization proper name, trade proper name, DBA name or disregarded entity name, fill it in here. If you exercise not have a business, you tin leave this line blank.

Line 3 – Federal tax classification

This section defines how you lot, the independent contractor, is classified when it comes to federal taxes. You will check the get-go box if you are filing as an private, sole proprietor or single-member limited liability company (LLC) endemic by an individual and disregarded for U.S. federal tax purposes. A sole proprietor business operates under the owner'due south Social Security number and hasn't been registered as another blazon of business organisation. Taxes use to single-member LLCs in the same way.

The other boxes stand for to C corporation, S corporation, Partnership and Trust/estate businesses.

The Limited liability company box is for a Partnership or LLC businesses with multiple members. Y'all can cheque this box if you own an LLC treated as a partnership for federal taxes (fill in "P" in the adjacent space), an LLC that has filed Class 8832 or 2553 and is taxed equally a corporation (fill in "C" or "South" in the next infinite depending on the type) or an LLC whose owner is another LLC not overlooked for federal tax purposes (fill in the appropriate letter in the adjacent space). If your LLC has not filed a request to be taxed as a C or Due south corporation, it is taxed every bit a Partnership. The "Note" on the grade clarifies the LLC-specific rules. You can always seek your attorney'southward or tax advisor'southward assist to ensure you consummate your form(s) correctly.

Line 4 – Exemptions

You practice not need to fill up in this department every bit an private. Only sure businesses or entities with any reason for exemption demand to fill out these spaces. If this applies to you lot, you'll need to provide a number or letter lawmaking that indicates that reason.

If your entity is exempt from backup withholding, you'll fill in the first line with your code. This should utilize to nearly entities. However, if your business is not, the visitor who hired you for your services will need to withhold income tax from your pay at a apartment rate of 24% and transport it to the IRS. This is known as backup withholding.

If you lot are exempt from reporting required past the Strange Account Tax Compliance Act (FACTA), yous volition fill in the 2d line. The latter only applies if you hold your accounts outside the U.s.. If yous maintain your account in the U.South., you can leave the second line bare or write "N/A." If y'all're unsure nigh your exemptions, Folio 3 of the form outlines situations that would make you exempt.

Lines v & 6 – Address, city, state, and ZIP lawmaking

Line 5 requires the address (number, street, and flat or suite number) where your employer will mail service your information returns. The following line, Line 6, leaves a space for you lot to enter the city, land and ZIP code of this address.

Line vii – Business relationship number(s)

This is an optional line where you can fill in whatever business relationship numbers your employer may need. Virtually individuals can go out this blank.

Part I – Taxpayer Identification Number (TIN)

You have 2 options in this section. You tin can enter either your Social Security number (SSN) or your employer identification number (EIN). Typically, yous provide your SSN if you file equally an individual or unmarried-member LLC. Use your EIN if you file equally a multi-member LLC classified as a corporation or partnership. If you lot are a sole proprietor, y'all could use either number, but your SSN is preferable.

If yous are a resident alien and you are not eligible for a SSN, y'all should use your IRS individual taxpayer identification number (ITIN).

Again, you may want to check with your revenue enhancement advisor or contact the IRS direct to double check your information. Providing an wrong Can tin cause problems with your payments or tax return. It tin can too lead to future backup withholding.

Part II – Certification

This is where yous sign and engagement the course, indicating that you lot provided your accurate information. This is a legal document, so it's important to read and follow all instructions carefully.

Again, proceed your safety in mind when completing and sending a W-ix. Before you even fill information technology out, verify that the asking for your form is legitimate. Likewise make sure to transport the completed class properly. Apply a secure method of delivery, like hand delivery, mail or encrypted file attachment. You want to brand sure yous're not accidentally sending your personal information to the wrong people.

How Are a W-4 and West-9 Different?

Y'all volition need to fill out a W-four when you lot've just started a new chore equally a full-time employee or your financial situation has changed (while notwithstanding remaining a full-time employee). A West-4 form requires some of the same information equally a W-9, like your name, address and Social Security number. These forms also request information on tax exemptions. Employers use the completed W-4 to determine how much to withhold from your paycheck for federal income taxes. Since an employer doesn't withhold income tax for contract and freelance employees, W-ix forms don't request that data.

What Is the Deviation Between a 1099 and W-nine?

The 1099 and W-9 forms go mitt in hand. Contained contractors fill up out the W-ix to confirm their tax responsibilities and provide information to their employer(s). In turn, employers use a contractor's Westward-9 to complete a 1099 detailing the worker'southward income.

At that place are 18 different 1099 forms, each one relating to the nature of the income. This includes freelance or contract income, just also real estate sales earnings, debt cancellation, pension contributions and more than. The amount yous need to report depends on the blazon of income, starting at as low equally $10 for interest gains and reaching up to $20,000 for special credit-card transactions.

As an independent contractor or freelancer, you'll receive a Due west-9 form when you begin your piece of work from the company using your services. Then in January, you'll receive your 1099-MISC form that documents your annual earnings. When you file your federal taxes, attach each of the 1099 forms y'all accept received. The visitor will also file your 1099-MISC with the IRS.

Bottom Line

A Due west-9 form is crucial to filing your taxes if y'all're a contract worker, a freelancer or self-employed. The companies you work with practice not have to withhold paycheck taxes for you, and the W-9 serves as an agreement that you are responsible for paying those taxes on your own.

Annotation that you do not send this class to the IRS. You send it to the employers who have requested it from y'all. While it's relatively simple to fill up out a Due west-ix, always double bank check to ensure your data is complete and accurate. If yous are unsure how to fill something out, consider looking for a tax accountant to aid yous make sense of your taxes.

Tips for Getting Through Tax Season

- For people who want some help staying organized, a financial advisor is a great resources. SmartAsset's gratis tool matches you with up to 3 financial advisors in your surface area, and you can interview your advisor matches at no cost to determine which one is right for you. If you're ready to find an counselor who can help y'all achieve your financial goals, become started now.

- If you're self-employed and have worked for a number of vendors, you'll have to fill out multiple W-9 forms. Each vendor who paid you more than than $600 in a given yr will transport yous a 1099 the following year, by January 31. If yous are missing a 1099, contact the visitor.

- Using the right tax filing software tin aid y'all ensure that all your tax forms are correct. If y'all aren't certain which to use, consider two of the most popular services, H&R Block and TurboTax. They both offer clear explanations of the process and a polish filing experience. Hither's a closer look at whether you should choose H&R Block or TurboTax.

Photo credit: ©iStock.com/alfexe, ©iStock.com/asiseeit, IRS.gov, ©iStock.com/mediaphotos

Source: https://smartasset.com/taxes/what-is-a-w9-tax-form

0 Response to "what should you put for the comany name if yourre self employed to set up direct deposit"

Postar um comentário